This article by Michael Goldstein was published on the Satoshi Nakamoto Institute website.

There’s a War Going On #

Bonnie and Clyde cannot simply rob First National Block Chain. They can hack servers and unencrypted wallet files or scan low-entropy brain wallets. But the costs of obtaining bitcoins hoarded on a high-entropy, password-protected paper wallet, for instance, are incredibly high. A computer cannot be expected to brute force the wallet in the universe’s lifetime, so a trespasser would have to employ expensive tactics such as kidnapping and torture on any prospective, individual target. Criminals, con artists, and swindlers cannot rely on violence to get the wealth they desire—it has become too cumbersome. These scoundrels must rely on good ol’ fashioned market forces.

And it’s working. Bitcoin is poised for exponential growth, so the opportunity costs of not being involved to the highest personal degree possible are incalculable. Yet merchants, investment peddlers, and other hoarders have been able to convince countless bitcoiners to part with their future riches, despite the obvious downsides given you have a long enough time horizon to see the coming post-fiat world. They’ll tell you spending is vital, that Bitcoin 2.0 will be even better if only you give them some of your Bitcoin 0.9, or that your bitcoins are worth only $475 a piece. They’ll tell you this with a straight face, the wringing of their hands unseen across the Internet. And once you have fallen to temptation, they’ll leave you on your own to learn there are no ‘backsies’. In the realpolitik of the block chain, everyone is a scammer. There is a war going on for your bitcoins, and willpower is your only defense.

Endless Scammers Everywhere #

Bitcoin is a dangerous place. There is an endless list of hacks, scams, and thefts. Bitcoin promises a network with distributed trust. You know why? Because other bitcoiners exist.

Not every bitcoin scammer is merely an amoral businessman or investor. Many are outright fraudsters and con-artists. When you buy a rug from Overstock, at least you actually get a rug. When you send money to Ethereum, you may actually get a worthless ether token eventually. You know what you probably will never get? Your Butterfly Labs pre-order or your Goxbucks.

Some scams are pulled off by convincing other bitcoiners to not take advantage of Bitcoin’s value proposition. That is, they convince bitcoiners that while they shouldn’t trust third parties, this guy is totally cool. I’m looking at you, Mt.Gox. Others convince them to play investment games that turn out to be Ponzi schemes. Sup, Bitcoin Savings and Trust?

Some scams are the purest synthesis of bitcoiner avarice and stupidity. Ponzi.io explicitly marketed itself as a Ponzi scheme, promising to send you back more bitcoins coming from the pockets of the next investors. Have fun. Their address, 1ponziUjuCVdB167ZmTWH48AURW1vE64q, received nearly 350 BTC.

Some scams are outright malicious. Scammers have resorted to malware and ransom. CryptoLocker infected computers by encrypting the user’s files and only gave up the private key if a ransom was paid in bitcoins within 48 hours.

Scammers have resorted to blackmail. On September 8th, a hacker gained control of Satoshi Nakamoto’s email account, using it not only to deface the Bitcoin sourceforge page, but to allegedly find out Satoshi’s true name. From a Vice article: “After inquiring what [the hacker] was trying to get out of all this, he said ‘Bitcoins, obviously… [But] don’t forget the lulz.’”

Scammers have also gone to the trouble of leaking nude photos of celebrities to get some bitcoins.

Scammers will do whatever it takes to increase their bitcoin holdings. You know this. You scammed someone to get yours. You probably did not outright defraud or hack someone like the above, but you necessarily took advantage of their short-term thinking.

Merchants are Scammers… #

At long last Newegg accepts Bitcoin, along with Overstock.com, TigerDirect, Dell.com, Expedia, and other major retailers and websites. So let’s go spend all our bitcoins, right? Not so fast. Let’s wipe off the drool from looking at all the shiny toys and think this through.

Merchants have absolutely every reason to accept Bitcoin. BitPay recently removed all fees for payment processing, including currency exchange. Not only can merchants receive payments without fees, but there are of course a litany of other benefits, from no fraud or chargeback to easy international payments. They can pass on their savings to customers or increase their profit margins. They also can and should hold onto bitcoins as their accounting permits, so as to earn profits from future price increases. After all, if Bitcoin increases adoption for payments, there are only so many units to go around, so each one will become more valuable.

So merchants are in a good position. They can save money on their business, and they can try to purchase bitcoins with retail goods, just as many purchase them with dollars or euros. If I were a merchant, I would most certainly encourage people to shop at my store in Bitcoin. I might even try to convince them, despite its fallacious economic reasoning, that spending bitcoins at my store is actually good for Bitcoin—certainly more than you saving and speculating on them. After all, “it could become worthless overnight” and “Its future depends on it” (because I say so). I might even say things like:

"[My] shoppers are among the first wave of Bitcoin users and we’re thrilled to accept the cryptocurrency as a form of payment. Just like you, we also believe Bitcoin can be the future of digital currency. But if you’ve been saving it and hoping it will make you rich one day, you’re better off spending it if you want it to succeed."

By me, I mean Newegg. Their recent blog post is called, “Why Saving Your Bitcoin is Not a Good Idea”. The reason? It means you aren’t spending at Newegg.

Most merchants even choose to immediately sell the bitcoins they receive. They scam you out of bitcoins they do not even want, uninterested in the future value of the network.

Merchants are scammers because they lead you to believe that your bitcoins are only worth the price of their retail good in order to allow themselves (or those to whom they sell the bitcoins, if they so choose), rather than you, to benefit from future Bitcoin price increases.

…And That’s a Good Thing #

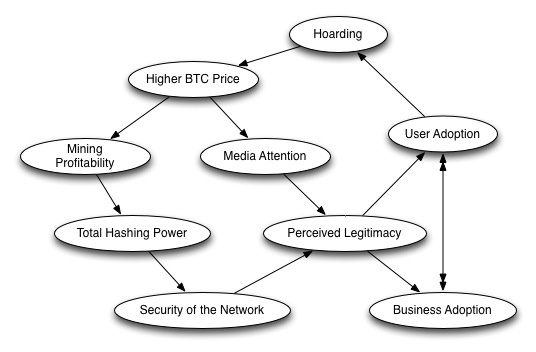

This is not to say merchant adoption is bad. In fact, from the hoarder’s perspective, merchant adoption is great. First, merchant adoption means that there is more demand for Bitcoin, that the Bitcoin network is growing, and that Bitcoin is thus more valuable than it was yesterday. Second, merchant adoption means there are more places to spend bitcoins.

This does not mean a hoarder will actually want to spend bitcoins. More importantly, he can spend bitcoins. Demand for cash exists because there is uncertainty of future needs, and the holder of cash believes he will come across currently unknown opportunities in the future that can better satisfy his needs than any current opportunities. When an opportunity exists that he believes benefits him more than what the same cash can get him in the future, he is able to seize it. As Metcalfe’s Law shows us, the value of a network increases exponentially with each additional node. With each additional merchant, there are more potential people to trade with, and thus more potential opportunities to satisfy his needs with cash.

Of course, these benefits to the hoarder does not require merchants accept Bitcoin, given the right infrastructure. Xapo debit cards, for instance, give the hoarder the ability to use bitcoins on existing credit card networks. This means hoarders can already use Bitcoin as their unit of account whether or not merchants even know what a bitcoin is. The more Bitcoin can be used as a method of payment the fewer dollars hoarders must begrudgingly speculate on, a risk they typically only wish on government agents and skeptical economists. Thus, the primary advantage of merchant adoption is that your average balance of bitcoins held can go up. You don’t need to buy dollars in anticipation of making dollar payments, instead you can replenish your bitcoin hoard after you make bitcoin payments.

Between merchant adoption and debit systems, Bitcoin becomes a more valuable good to hoard. Good news for Bitcoin!

Investments are Scams… #

Bitcoin is exciting. Looking at a static wallet file and balance is not. Instead of holding and forgetting, many bitcoiners choose to “put that money to use,” and endless crypto-peddlers are ready to snatch your bitcoins up. They’ll offer you mining contracts, present their plans for a hedge fund, or entice you into investing in a Bitcoin company. Today, the most popular investment vehicle for bitcoiners are Bitcoin 2.0 schemes, ranging from Mastercoin to Ethereum.

All of these are scams.

Regardless of their ability to actually deliver their promises, they all fail a simple test: is the return on investment positive? If you are stuck in a fiat mindset, you may well make a quick buck, but given Bitcoin’s extraordinary expected growth, can one really expect to do better than one can by holding it? Long term investors should use Bitcoin as their unit of account and every single investment should be compared to the expected returns of Bitcoin.

If hyperbitcoinization occurs, Bitcoin holders will see their purchasing power increase by orders of magnitude. Bitcoiners should think twice before throwing away even a couple millibits towards a project “just to see where it goes.” A running joke in the community is how expensive the two pizzas Laszlo bought were. We joke about a million dollar pizza, and hyperbitcoinization has not even occurred yet. I praise Laszlo for his entrepreneurial use of a new technology, but I do not wish for myself or others to be a Laszlo.

Who wins here? It is not the investor, but the peddler of crypto-dreams. Ethereum recently raised $15 million in their “Ether sale” for an unfinished project, in Bitcoin, of course. There isn’t even a product yet, but investors have placed their bets. Ethereum now has over thirty thousand bitcoins, destined to be worth unspeakable volumes of wealth, while investors hold worthless hope.

Investments are scams because they lead you to believe you can get a higher return than holding bitcoin itself, despite the economics of bitcoin naturally making this an absurd claim in the medium-run. In a post-fiat world, there will be plenty of investments that have a greater return (and risk!) than holding bitcoins, but they’ll be assets that generate bitcoin cash flows.

…But They Don’t Have to Be #

If a Bitcoin hoarder wants to reinvest his profits, he need not further than the Bitcoin network itself. The correct strategy for Bitcoin entrepreneurship, as Daniel has pointed out, is speculative philanthropy. While endless money has been funneled into altcoins, appcoins, vaporware, vulnerable third party services, etc., there are many problems in Bitcoin that still need to be solved through open source development, many of which are low-hanging fruit. By funding these projects, the security, accessibility, and usability of the Bitcoin network increase, thus making it an even better investment.

Get coding. Every new git commit is good news for Bitcoin.

Hoarders are Scammers 1… #

The Bitcoin hoarder is in a constant battle with himself to lower his time preference as much as humanly possible. It’s the only way to optimize his Bitcoin holdings. My friends and I joke about starving due to the intense deflation, but I can’t say I don’t look back and wish I had skipped a couple lunches in the crappy dorm cafeteria to buy $10 bitcoins when I had the chance.

Bitcoin hoarders are excited about the price rises, but they are also excited when the price is on its way down. Coinbase just months ago was willing to give me a bitcoin for $1200, and now they are only asking for $475. Whatever price, the bitcoin hoarder thinks to himself, “Suckers.”

Bitcoin hoarders are in it for the long run. Their strategy is not to buy low, sell high, but to buy any, sell some highest. They will do anything to get their hands on more satoshis, and there is nothing that makes them happier than a schmuck giving up the goods after being convinced Bitcoin is only worth $[x < moon]. These sellers have volunteered to hold the fiat shitbag, and hoarders will not be so quick to help them get rid of the stench.

Indeed, hoarders are potentially the most dangerous scammers. While merchants and investments are outright with their desire to take your bitcoins, hoarders may not always be so explicit. A person can prove that they have the private key to bitcoins, but they cannot prove they do not. With this in mind, it is plausible that any vociferous skeptic’s bold assertion is actually a psyop attempting to affect market demand, and subsequently the price, in their favor. For instance, when Paul Krugman recently said in “The Long Cryptocon” that “it’s not at all clear whether [Bitcoin technology] has any economic value,” we cannot know with epistemological certainty that Paul Krugman is not a Bitcoin True Believer hoping to get his hands on more and cheaper bitcoins.

Hoarders are scammers because they understand the exponential (and very likely) growth potential of Bitcoin, yet are willing to convince other bitcoin holders by any means necessary that the future value to them is probably not much more than the current market price.

…And You Should Thank Them #

Hoarding is what gives money value. And no, you can’t have any.

Great news for Bitcoin!

How to End it All #

Indeed, Bitcoin scamming is a job that will never be finished. The market-based scams (that is, ones that don’t require fraud) will subside as Bitcoin absorbs the real money supply of all other currencies, when demand for cash begins to decelerate and eventually stabilizes. However, other scammers will always be looking for ways to screw someone out of their bitcoins.

The only way this will be solved is if trusted networks can be built. As has been said before, Bitcoin is great, but it won’t fix our monkey brains. While Bitcoin offers a money with no trusted third party, it can only do so because the ledger is self-referential. The humans actually using it must always be in a mindset of caveat emptor when using Bitcoin. Through payment protocols, webs-of-trust, smart contracts, GPG contracts, and voting pools, users can mitigate the risk of engaging in various forms of commerce.

The Only Winning Move is Not to Spend #

We live in a state of total war. Everyone who holds bitcoins is trying to get more by scamming others out of theirs or convincing others it’s not worth trying to get into. Everyone who does not hold bitcoins was either scammed out of them or was scammed from getting into it. Having bitcoins takes the knowledge and will to know and desire its future, while not having or spending them is lacking one or the other. If you hold bitcoins, you must take a breath every time you wish to send any to another person. Ask yourself if that person truly deserves untold amounts of your future wealth for pouring you a beer. You may just find the will to hodl more.

Hyperbitcoinization will not be a force to trifle with. Even a marginal bitcoin holding right now will constitute a very significant majority of a bitcoiner’s portfolio. Once it happens, there is no going back. One day, your Bitcoin balance will likely never see the decimal point move to the right again. Bitcoin will brake for no one on its race down the road from serfdom to global domination (liberation?). Do not give your seat up for someone else.

“Scammer” is a heuristic, not an accusation.

Revised October 7, 2014 - Added a paragraph describing inability to discern Bitcoin skepticism from hoarding psyop. ↩︎