This essay by Gigi was published on dergigi.com website.

Video bitcoinized by RD ₿TC, based on an edit by Ampleforth.

Original source: An interview with F.A. Hayek (1984)

Law. Language. Money. The three paradigms of spontaneous and emergent order in society. Moral questions are at the root of it all:

- Who should be allowed to speak?

- Who should be allowed to publish?

- Who should be allowed to have property?

- Who should be allowed to defend said property?

- Who should be allowed to issue and control the money?

It might not be obvious at first, but these questions and their respective areas - law, language, and money - are all related. They are related in general, but, more importantly, they are intimately related in the Gordian knot that is Bitcoin. Allow me, at least for a moment, to try to untangle this knot. Hopefully, without losing the thread that makes all of it hang together.

Let’s begin with the last question: the issuance and control of money.

Issuance and Control of Money #

“Permit me to issue and control the money of a nation, and I care not who makes its laws.”

— Mayer Amschel Rothschild

As Hayek pointed out in the Denationalisation of Money, the government monopoly on the issuance and control of money is the root of all monetary evil 1.

If you control the money, you control the purchasing power. Which, in turn, allows you to control most other things.

This is neither hard to see nor hard to understand: if you can dictate who gets the money, you can dictate who is well off and who is not. If you can decide who is allowed to create new money, you can decide who has to work for money and who gets it unjustly, with the stroke of a pen or the push of a button 2. If you can control the flow of money, you can decide who can pay, who can get paid, who can withdraw, who has access to their bank accounts, and who has access to financial infrastructure in general. In short: you can decide who will be deplatformed from society. In the most extreme cases, this is a matter of life and death. Who gets to eat and who must starve; who gets to prosper, and who must perish.

This is why questions on the control and issuance of money are first and foremost ethical questions 3. It is a moral problem, not a technical one.

The nature of money is as multifaceted as it is elusive. Without a deep understanding of money and an appreciation for its importance, it is very hard to understand the ethical quandary of money production and dissemination.

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

— Henry Ford

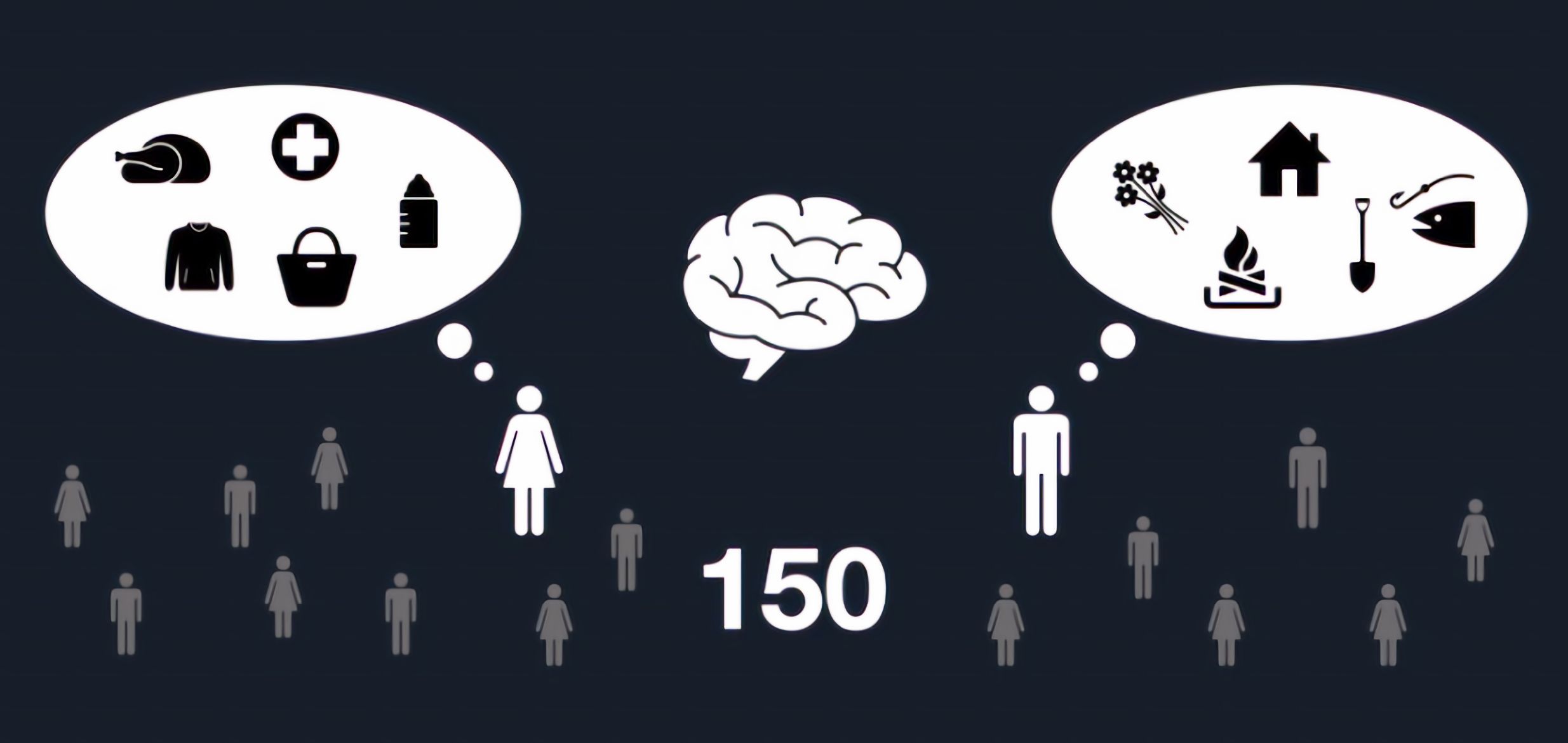

Money can be traded for goods and services. These goods and services are produced and offered by strangers. The “stranger” part is important because money is the one thing that effectively and peacefully allows us to scale across trust barriers. With money, you don’t need to trust your counterparty — that’s the whole point. If the counterparty is a good friend of yours, you can rely on credit. Final settlement is what removes the trust barrier and allows societies to scale 4. Without money, human cooperation has to rely on credit relationships. Everyone has to remember who owes what to whom. Without an external representation of these relationships—if everyone has to keep all these ratios in their head — human cooperation can’t scale beyond Dunbar’s Number, resulting in a maximum group size of about 150 people.

Money, however, is not only used for scalability. It is also used for measurement. Thus, in the grand scheme of things, money is a measure of what society owes you. The whole purpose of money is that you can redeem it for something else, anonymously and with final settlement. Again: Final settlement means that the deal is done; you are not indebted to your trading partner anymore. With the exchange of money, the exchange is final.

Consequently, money is the life-blood of all large-scale economic activity. The importance of money and the free flow thereof can’t be overstated. If we want to live in a free, peaceful, and prosperous society, we must not interfere with the issue and control of money. After all, as Frédéric Bastiat famously said, “When goods do not cross borders, soldiers will.”

Fundamentally, there are two ways to get your hands on the things of strangers: trade and violence 5. The difference between cooperation and conquest is that one interaction is voluntary, while the other is not. Money not only facilitates and scales trade, it is also used to express individual preferences and valuations. How much are you willing to spend for a certain good or service? Are you willing to spend money at all, or would you rather save? How long are you willing to hold on to your money? How much are you willing to invest in certain ventures? Answers to such questions are expressed in the language of money, which is why the flow of money is not dissimilar to the flow of information, or speech.

This brings us to the next question. The next two, actually: who should be allowed to publish? And, who should be allowed to speak?

Freedom of Speech (and Publication) #

“Give me the liberty to know, to utter, and to argue freely according to conscience, above all liberties.”

— John Milton

“Without free speech no search for Truth is possible; without free speech no discovery of Truth is useful; without free speech progress is checked, and the nations no longer march forward towards the nobler life which the future holds for man. Better a thousandfold abuse of free speech than denial of free speech. The abuse dies in a day; the denial slays the life of the people and entombs the hope of the race.”

— Charles Bradlaugh

“Without an unfettered press, without liberty of speech, all the outward forms and structures of free institutions are a sham, a pretense—the sheerest mockery. If the press is not free; if speech is not independent and untrammelled; if the mind is shackled or made impotent through fear, it makes no difference under what form of government you live you are a subject and not a citizen.”

— William E. Borah

Countless philosophers, authors, thinkers, activists, freedom fighters, saints, revolutionaries, and religious leaders have made this point in the past: freedom of speech, the ability to speak freely without censorship, is absolutely essential for a free society. We must be able to identify and speak about problems to have a chance of fixing them. And, more importantly, we must be able to express our thoughts freely if we want to think in the first place.

Sound conversations facilitate distributed cognition, much like sound money facilitates distributed production. And just like the purpose of money lies in exchange, the purpose of speech lies in dialogue (or dia-Logos, to use the Vervaekian vocabulary).

“In the beginning was the Word, and the Word was with God, and the Word was God. The same was in the beginning with God.”

— Gospel of John

There is a reason why the Logos is sacred. The divine Word. Speech, statements, discourse. It is discourse that makes the freedom of publication a necessity. After all, what use is your right to free speech if nobody will ever be able to hear you?

The U.S. constitution got this right:

“Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof; or abridging the freedom of speech, or of the press; or the right of the people peaceably to assemble, and to petition the Government for a redress of grievances.”

— First Amendment to the United States Constitution

Freedom of speech. Freedom of the press. It is the first amendment for a reason, since it is so unbelievably important. If we have free speech, we have a chance at liberty. If we lack free speech, we have the certainty of tyranny.

“Freedom of speech is the great bulwark of liberty; they prosper and die together: And it is the terror of traitors and oppressors, and a barrier against them.”

— Cato, Letter Number 15

“Liberty is meaningless where the right to utter one’s thoughts and opinions has ceased to exist. That, of all rights, is the dread of tyrants. It is the right which they first of all strike down. They know its power. Thrones, dominions, principalities, and powers, founded in injustice and wrong, are sure to tremble, if men are allowed to reason of righteousness, temperance, and of a judgment to come in their presence.”

— Frederick Douglass

For all our flaws, this is the one thing we got right. The Logos is sacred, as it should be.

Bitcoin is Free Speech Money #

Why is all of this important in the context of Bitcoin? As myself and others have argued many times before, every component of bitcoin is text, which makes bitcoin equivalent to speech. Bitcoin is Free Speech Money, both figuratively and literally.

What Bitcoin’s code facilitates can be understood as a language game, an ongoing process of publication and rejection 6. Miners publish blocks, full nodes accept or reject said blocks, users publish transactions, ASIC chips publish hashes of random inputs, and so on. “It is all text, all the time,” as Beautyon 7 has so succinctly put it. Consequently, as he points out, “it cannot be regulated in a free country like the USA with guaranteed inalienable rights and a First Amendment that explicitly excludes the act of publishing from government oversight.”

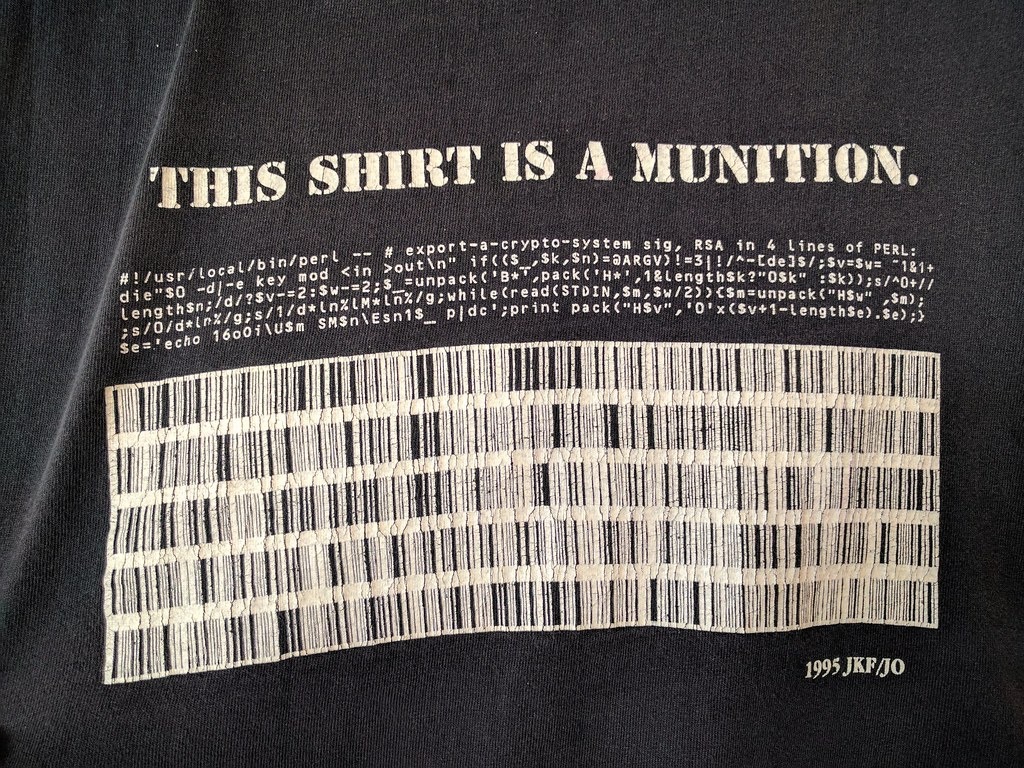

Understanding these fundamentals is important in more ways than one. If we mistake speech for something which it is not—ammunition, for example—we run into a conflict with the First Amendment, as the Crypto Wars have clearly shown in the past. Because of the nature of information, outlawing speech will always lead to ridiculous consequences, such as illegal numbers, illegal primes, illegal art, illegal books, illegal sounds, illegal t-shirts, and all the rest of it. It can also lead to dangerous consequences: if the stifled information is a warning signal—or some other indication that something is wrong—error correction can’t happen.

However, words convey meaning, as does information. And this meaning is and always will be disconnected from the form that said information takes 8. Words are pointers, not reality. If you outlaw a certain word, people will just use something else in its place, something that will convey the same idea, something that will have the same meaning. This is also why outlawing any piece of information is not only futile but ridiculous. Information can take on virtually endless forms. Consequently, by outlawing a certain piece of information, you automatically ban books, music, and all other possible representations of said information, which, depending on your encoding, might be anything 9.

We went through this in the past. The classification of RSA as munition led to exactly such a conflict of free speech, which is why t-shirts that have the forbidden information on them were printed in the first place: to show how ridiculous it all is.

The Crypto Wars have never ended.

This is precisely why outlawing bitcoin unavoidably leads to thoughtcrimes, illegal numbers, illegal primes, and illegal speech. If publishing a certain block, nonce, or transaction is ever deemed illegal, the publication of said block, nonce, or transaction by ways of books or the press will be illegal too. And because all aspects of Bitcoin are information, having certain thoughts—such as 12 words in your head—would be illegal too.

Which brings us to the question of enforcement, and the last two questions of our initial list: Who should be allowed to have property? And who should be allowed to defend said property?

Enforcement & Defense of Property Rights #

In the physical realm, property rights are enforced by violence or the prospect thereof. It doesn’t matter much if an individual, the Mafia, or the State is the ultimate dispenser of this violence. The fact that there are no unbreakable safes, no unpickable locks, and no unbreakable glass—in short, no indestructible barriers—requires retaliation if property is violated.

This raises the question: what exactly constitutes a violation of property rights? In liberal democracies, the “trias politica” of the state—legislative, judicial, executive—is what tries to answer this question and resolve disputes. As Bastiat put it, the law exists because property can be violated, not vice-versa.

“Life, liberty, and property do not exist because men have made laws. On the contrary, it was the fact that life, liberty, and property existed beforehand that caused men to make laws in the first place.”

— Frederic Bastiat, The Law

The fact that physical things are scarce and can be stolen or destroyed is what brings property rights into existence in the first place. Property rights are a solution to the potential conflict of who can use which scarce resource.

The informational realm is very different. Information is non-physical; it can not be attacked or destroyed directly. As Wei Dai put it in his b-money proposal: “the threat of violence is impotent because violence is impossible, and violence is impossible because its participants cannot be linked to their true names or physical locations.”

Information itself doesn’t have a physical location. The nature of information is such that information—knowledge—can only be shared, not stolen. Information has non-scarcity built-in. To distribute information is to copy it—with perfect fidelity and without sacrifice. The speaker still retains his knowledge. Consequently, Bitcoin does not create digital information that can’t be copied. Such a thing can never exist.

What Bitcoin does is it creates an infinite game that anyone can join, a game with certain limitations. These limitations are not unlike the limitations in a game of chess. The squares on the board are scarce because everyone wants them to be scarce, not because they can’t be copied or modified. We could play a different game with twice as many squares, but that doesn’t mean that this game will be played. Like a game of correspondence chess, Bitcoin is a game of language. A game in which various players utter phrases to each other that are meaningful to them individually. Messages are passed back and forth, and participants do nothing but accept information they deem valid and reject information they deem invalid. It is Dialogos at its core, utilizing the nature of information to its advantage, as Satoshi pointed out.

“In a nutshell, the network works like a distributed timestamp server, stamping the first transaction to spend a coin. It takes advantage of the nature of information being easy to spread but hard to stifle.”

— Satoshi Nakamoto

Let me repeat the second sentence for emphasis: Bitcoin takes advantage of the nature of information being easy to spread but hard to stifle.

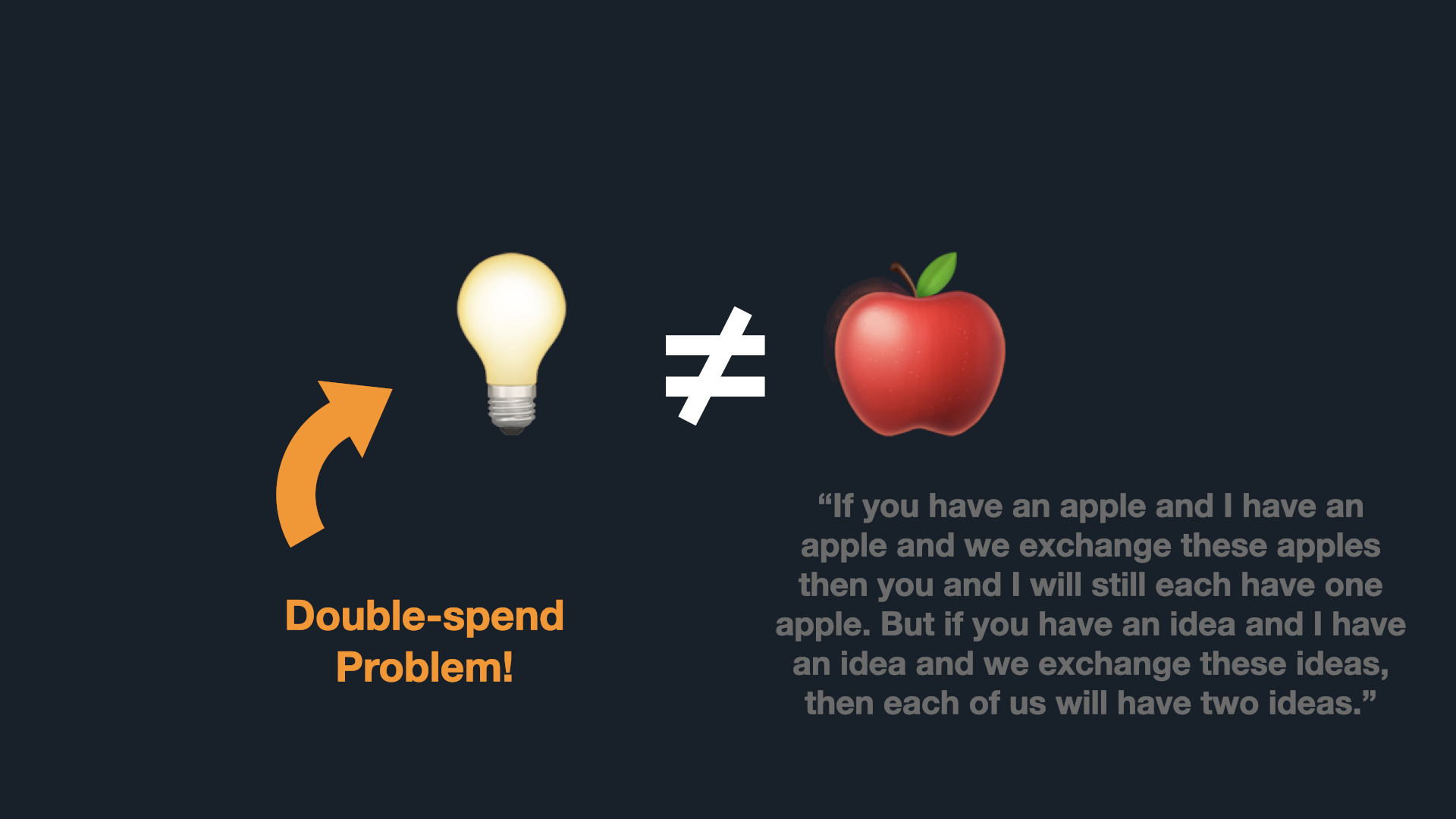

We must accept that the nature of information is very different from the nature of physical objects. While you can own an apple, you can’t own a word or a number in any meaningful sense. If you want to exclusively know something, then you must not share it. You must keep it secret. As George Bernard Shaw so succinctly put it: “If you have an apple and I have an apple and we exchange these apples then you and I will still each have one apple. But if you have an idea and I have an idea and we exchange these ideas, then each of us will have two ideas.”

These two sentences perfectly encapsulate the problem of digital money. You can’t double-spend an apple, but when it comes to information, there simply is no way to not double-spend it. Passing on information is “double-spending” said information, which, coincidentally, makes the idea of “digital scarcity” an oxymoron. Bitcoin does not solve this oxymoron; it circumvents it. The rules of the game make invalid information useless, not uncopyable. Blockspace is scarce like the squares on a chessboard are scarce: by social consensus on how the game is supposed to be played.

The question becomes: how is the game supposed to be played? What are the rules of the game, and who can change them? Bitcoin’s Blocksize War 10 was about this question. The resolution of the blocksize wars showed one thing clearly: in the end, individual users define, verify, and enforce the rules. The full node is sovereign, as are the users behind said nodes.

“An apparently overwhelming economic interest group [wanted to change the rules]—85% of miners, many big-block philosophical supporters in exchanges, payment processors, a superficially daunting business lobby group—and they lost, because the market prevailed, and activist investors said NO. And meant it.”

This precedent is important if one wants to understand the various incentives and dynamics that secure the Bitcoin network. While enforcement of Bitcoin’s rules is automated via code, what Bitcoin is and what it should be—which rules are sacrosanct and which rules might be changed—is a matter of overlap in individual perception, not dictate. There is no instance that is in charge of the rules. There are only players that want to play according to certain rules, and once they have a way to communicate with each other, the game can be played.

It is important to note, however, that Bitcoin is an ongoing, infinite game 11. It started with the Genesis Block, and it has been and is being played by myriads of players ever since.

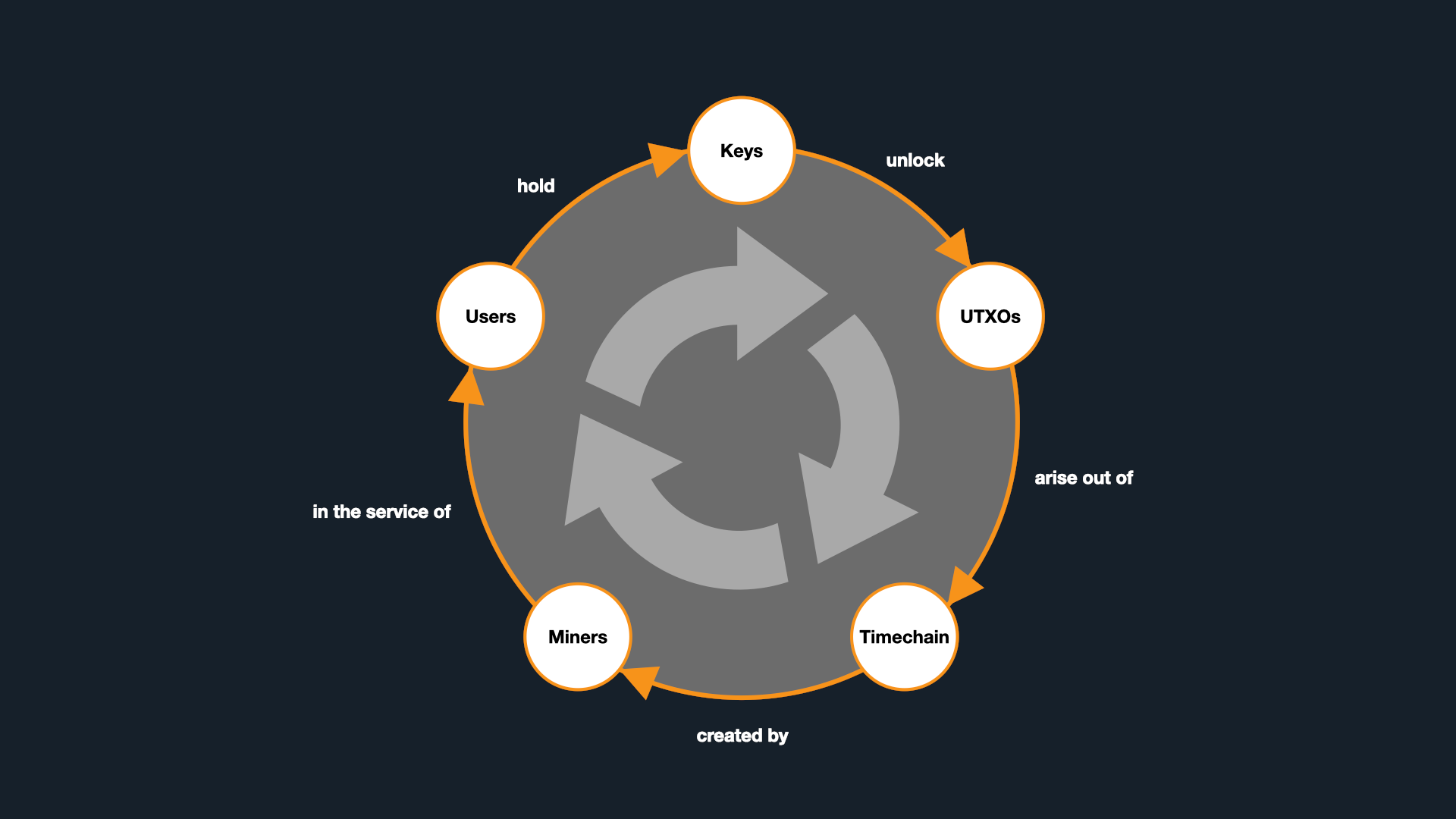

The goal of the game is to create an indisputable past in an ongoing fashion, and it goes something like this:

- Miners are rewarded with sats to create and protect the past

- Nodes validate this past, creating the network that pays the miners

- Users imbue sats with value

Users, nodes, and miners are not exclusive roles. You might be one, two, or all three 12.

It’s peaceful, I swear. Even with fiat dying on the ground.

The question about what Bitcoin was and what the rules of the game have been are visible to all. Dispute arises when we want to define what Bitcoin is and, more importantly, what Bitcoin should be in the future. Rule agreement happens in the social layer; enforcement happens via code.

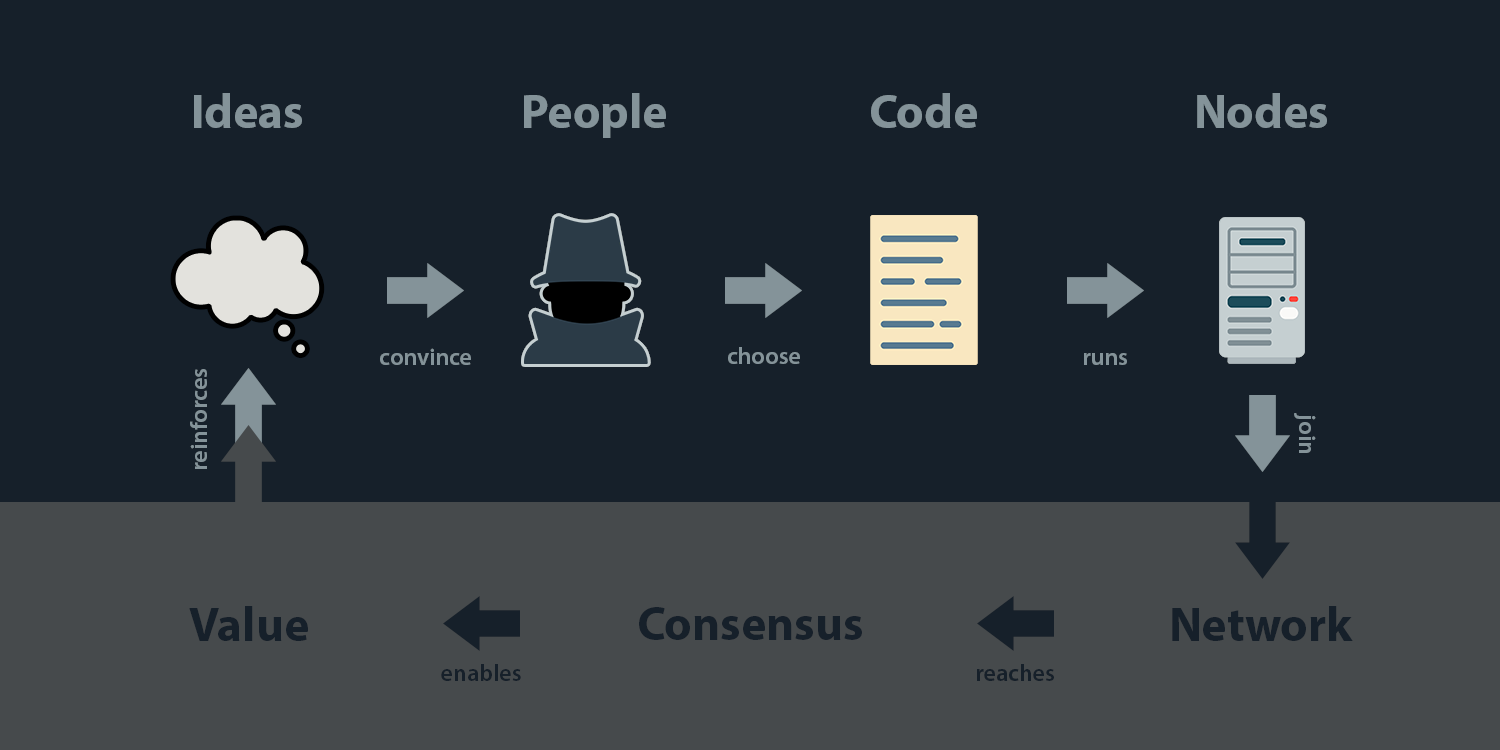

Further, every player is in charge of his own rules. Thus, to introduce a new rule, you would have to convince every player that your rule is worthy of adoption. That it is better, fairer, or more fun to play with your new rule. And if your new rule is incompatible with the game that we have all played in the past, you will have to convince everyone—otherwise, you will split the game in two, creating a fork.

By making rule validation part of the ongoing play itself, Satoshi managed to create a system that is verifiably unchanging. And because nobody is in charge, you can always choose to play by the original rules.

“The nature of Bitcoin is such that once version 0.1 was released, the core design was set in stone for the rest of its lifetime.”

— Satoshi Nakamoto

This is why the blocksize war was not really a war about block size; it was a debate about the soul of Bitcoin. A dialogue about Bitcoin’s future, a disagreement about what Bitcoin is and should be.

The debate was, in the end, resolved with a chain split. An incompatible rule change that—because not everyone agreed with the incompatible change—split the Bitcoin network, and its community of users, in two.

This has happened multiple times since, and it will most likely happen again. It is an unavoidable consequence of any decentralized game. Everyone is free to play by their own rules. Everyone is free to fork off.

A Strange Loop of Law, Language, and Values #

Allow me to revisit the moral questions that we outlined in the beginning and answer them on my behalf—which is to say Bitcoin’s behalf, strangely enough. Because, at least currently, my rules—the rules that are responsible for enforcing the answers to these questions—are in consensus with the Bitcoin network.

- Who should be allowed to speak? Everyone.

- Who should be allowed to publish? Everyone.

- Who should be allowed to have property? Everyone.

- Who should be allowed to defend said property? Everyone.

- Who should be allowed to issue and control the money? Everyone and no one.

The answer to the last question shines light on a common misconception in Bitcoin: miners are not creating bitcoin; they are discovering bitcoin that already exists in the mathematical space defined by the protocol. The issuance of bitcoin is fixed in time, not computation. It is pre-determined via the rules of the system and completely unrelated to its energy expenditure. Issuance and security—and transaction throughput, for that matter—are completely orthogonal to each other, as Pierre Rochard 13 and others have correctly pointed out in the past.

Above all, the question that is the hardest to grasp for those new to Bitcoin is the question of who is in charge of the rules, which brings us to a final, crucially important moral question:

- Who should be allowed to force others to change their rules? No one.

You can’t force me to play by your rules because I can choose to play this game how I please. All I need is a way to listen, think, and speak. And as soon as some other player agrees with my version of the rules, a networked game can be played.

In the end, this agreement is a question of values—moral values, first and foremost, but economic values too. Consensus arises if enough people play by the same rules. For this to happen, players first need to agree that the game is worthy of being played; that the moral values embedded in the game are something they value. It is this idea-value feedback loop that brings economic value into existence.

Bitcoin is so weird because it does the seemingly impossible: it pulls itself up from the bootstraps, becoming more valuable and more secure as time goes on. In short, Bitcoin issues bitcoin to secure itself. The network brings sats into existence, and it is the value of these sats that secures the network in turn.

It’s all interlinked. Sats only exist because the Bitcoin network exists. The network continues to exist because sats exist and have value.

Bitcoin’s core rules are “set in stone” because of the dynamics of this ongoing game of words and values. The rules are embedded and linked to the past; existing players value the rules of the game, or they wouldn’t have joined voluntarily in the first place. As we shall see, value is linked to security, which is probably the most confusing thing about Bitcoin’s strange loop of law, language, and money. If we can’t rely on trust or violence, we have to rely on mathematics and money.

This is why Bitcoin had to grow like an organism to become truly resilient. Without a trusted third party, both value and security have to grow organically over time. This is why Satoshi did not welcome too much unnecessary attention in the early days 14. It was his responsibility to protect Bitcoin when it was still a sapling. Bitcoin is not a sapling anymore, but the same forces are still at play: an endless loop of words and values, protecting themselves by running the numbers.

Looting the Loop #

Because Bitcoin is just information, it has to use information to protect other information via a process of hiding and binding. The confusing part in Bitcoin is the binding part because Bitcoin, as we alluded to earlier, uses economic binding in addition to the good old mathematical binding of public-key cryptography.

We should remember that information can only be protected probabilistically, no matter what. As we have seen, information is non-scarce. You can have the same idea as someone else without stealing the idea. No matter the secret, in theory, you could always be lucky and guess the secret.

The reason why modern cryptography works is that it makes use of an outrageously large search space, which makes any randomly chosen secret virtually impossible to guess in practice. We can confidently slap the label “impossible to guess” on it because guessing—flipping bits—requires time and energy. In Bitcoin, for example, the space of all possible private keys is so mind-bogglingly large that no supercomputer could ever guess it in a reasonable amount of time. It will always take millions of years, even using the best computers that we could possibly build. This is why, practically speaking, securing information with strong cryptography is unbreakably secure. Given that the private information remains private, of course.

Using private information is the conventional way to secure public information cryptographically. It is also the conventional way to ensure its validity and integrity. Someone holds a private key, and this person or entity is responsible for keeping the key secret. Consequently, the security/integrity of the encrypted/signed public information relies on this trusted third party.

Here is the riddle to be solved: how can we create public information with similar security and data integrity guarantees without the use of any private information?

Remember that money is just a ledger, a list of who owes what to whom. If we want this ledger to be trustworthy, it needs to be public and auditable. Further, we need strong assurances of authenticity, i.e., we need to be able to trustlessly verify that nobody tampered with past records and that the records are not made up. That’s why we need the costly signal of proof-of-work: to create a past that is unfathomably expensive to fake. You are bound to the result via the very real costs that had to be sunk into creating the signal in the first place.

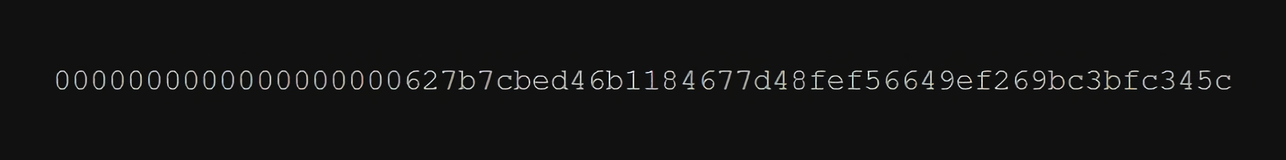

In Bitcoin, anyone can look at the block hash of the current block, 729170, and know at a glance, just by looking at the leading zeroes, that a lot of work—or, in other words: time, energy, and money—went into creating this string:

It was costly to find this number. Someone or something had to think very hard to be able to speak it. The reason why we can be so confident in the costliness of this block hash is that—according to the rules—its very existence is highly improbable. The fact that it exists and that it is valid is what makes it part of the ongoing game that all bitcoiners play. Its validity makes it accepted by the network, turning it into one building block of the timechain’s past.

Further, this building block contains all of Bitcoin’s history. It contains a hash of the previous block, and the previous one contains a hash of the block that came before, and so on and so forth, all the way back to the Genesis block. This little piece of information speaks for all of Bitcoin’s unchanging history up to the point of its creation. A history that you can’t simply make up—you have to bring it into existence by rolling the dice, by playing the game according to its rules.

One of the clearest thinkers when it comes to this property of proof-of-work is probably Adam Gibson, who wrote at length about this reification of information. Because thinking requires energy, and because playing in accordance with the rules requires thinking, Bitcoin’s blocks are informational constructs that behave as if they have concrete, material existence.

“Demanding a low entropy output from a hash function results in a costly signal which is very unambiguous and easy to verify […] The creation of these hashes represents a kind of reification of information. The zeros in the above block hash digest are just a pattern, but hidden in that pattern is a real energetic raw cost, that can be quantified. […] In an adversarial environment, one in which there are stakes, picking out the “real” from the “fake” means identifying signals which are objective, and the only signals that are objective are the ones that are demonstrably costly. […]”

Demonstrably costly signals are the only thing that can publicly prove that something has happened—without the need of any secret information. And, more importantly, without the need for any keepers of this secret information. This is also why all good money needs to have unforgeable costliness, as Szabo pointed out in the past. Anything that doesn’t have any real cost—cost that is immediately obvious and can be verified by anyone at a glance—can be trivially forged or simply made up. In the words of Hugo Nguyen: “By attaching energy to a block, we give it ‘form’, allowing it to have real weight & consequences in the physical world.”

If we remove this energy, let’s say by moving from miners to signers, we reintroduce trusted third parties into the equation, which removes the tie to physical reality that makes the past self-evident.

It is this energy, this weight, that protects the public ledger. By bringing this unlikely information into existence, miners create a transparent force-field around past transactions, securing everyone’s value in the process—including their own—without any use of private information.

Here comes the part that is tricky to understand: the value that is protected is not only value in the monetary sense, but the very moral value of the integrity of the system. By extending the honest chain with the most work, miners choose to act honestly, protecting the very rules that everyone agrees to. In turn, they are rewarded monetarily by the collective that is the network.

It is important to differentiate between morality and monetary value because Bitcoin wasn’t created to make money; it was created to fix the money. It was created to go beyond the broken moral frameworks of existing monies, to bring something into existence that can’t be captured and corrupted easily.

This is why Satoshi chose to build a system with an unchanging soul. This is why the rules have been “set in stone” since day one. Bitcoin’s consensus rules are what provide definitive answers to the ethical questions listed in the opening paragraph. Questions of money production, control, freedom, and sovereignty. Bitcoin embodies moral values; its rules define how the game of money should be played. Stray from these values, and you will destroy what made Bitcoin valuable to people in the first place. Break the moral code, and it will be worthless in the long run.

The circular nature of Bitcoin makes everything hang together: the supply cap of 21 million derives from the full sovereignty of the user over her node. It is protected by a symbiotic relationship between users, miners, and the nodes that make up the network. Bitcoin puts the individual at the center, removing the need for rulers and putting rules in place instead.

Bitcoin is free software, free as in freedom. As long as users have and make use of the four essential freedoms inherent in free software, anyone is able to run the numbers and voice their individual preferences. By speaking their own individual truths and rejecting the lies of others, users can easily and cheaply pronounce that invalid blocks need not apply.

Likewise, miners are free to run the numbers on their end, providing public protection via a perfect competition that only requires thinking and speaking—or, in other words: electricity and a communications channel—to enter. Miners are rewarded with a currency that is internal to the network, which aligns incentives and makes the relationship symbiotic.

In other words: the security of the public record depends on the value of the sats that are held in private, and the value of the sats depends—at least in part—on the security guarantees of the public record and the confidence in the integrity of its past and future.

To disrupt this ongoing game in any meaningful sense, you have to overwhelm all honest players by expending resources only useful in the game itself. It is way more profitable to protect the system and its rules: honest play is rewarded, dishonest play is not. Further, any disruption will devalue the sats that are used to repay those who play the game. In addition to all of that, if a motivated attacker continues to disrupt the play for prolonged periods of time, there is always the chance of a large-scale user revolt, as has happened in the past. Users are free to change the rules ever so slightly—via a user-activated soft-fork, for example—which provides an additional layer of protection against disruption. Any dishonest player thus always runs the risk of losing out on rewards completely. Just like the mathematical binding that makes any guessing of Bitcoin’s private information unfeasible, this economic binding makes any corruption of Bitcoin’s public information unprofitable.

Because of this, Bitcoin can be understood as “vitrium flexile,” to use a mythical reference. The glass of Roman legend—a transparent substance that is virtually indestructible. Bitcoin creates a global vault made of this substance, and because it can only protect its native asset, it is as if this glass vault would empty itself as soon as someone tried to break the glass.

Ten-tenths of the Law #

The whole point of Bitcoin is to remove humans from the issuance and control of money. As Szabo put it: “[Bitcoin] implements data integrity via computer science rather than via ‘call the cops’”. Nobody can help you if you lose forget your private key. Nobody can reverse a transaction once it is confirmed and buried beneath a couple of blocks. It doesn’t matter who you call.

We all know the saying that possession is nine-tenths of the law. Bitcoin, however, is binary. In Bitcoin, possession is ten-tenths of the law. And it is not possession in the ordinary sense.

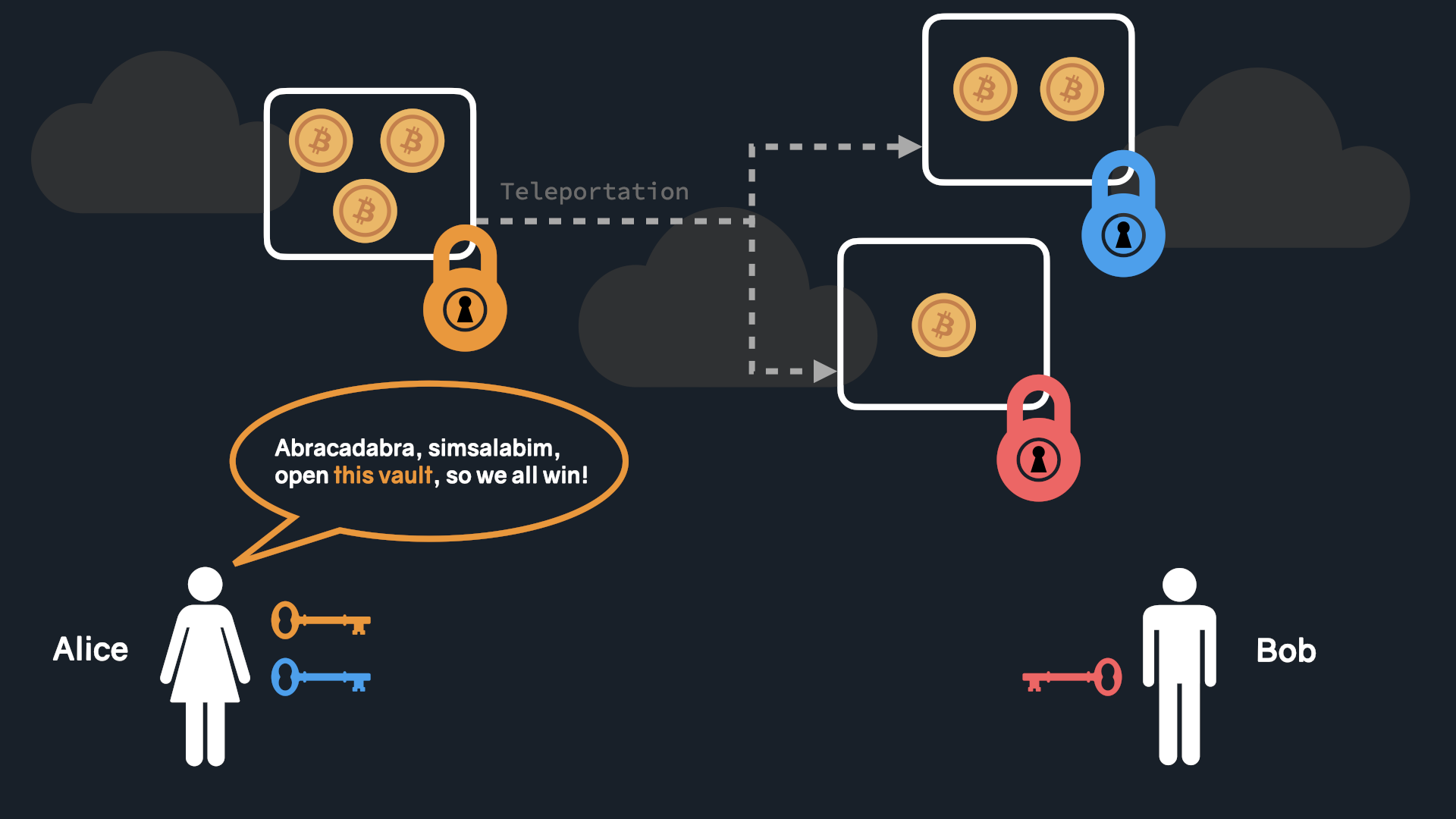

A private key is information, which means that possession is knowledge—secret knowledge. In that sense, “owning” bitcoin is knowing a secret. This fact is why you can hold bitcoin in your head. In Bitcoin, “owning” is knowing.

However, “ownership” alone is not enough. You also need the corresponding public information that makes your secret phrase useful. After all, a magic spell is only useful if it changes something in the real world, something that everyone can verify with their own eyes. In Bitcoin, this is the public ledger: the verifiable record of who “owns” what.

Technically speaking, your private key allows you to spend UTXOs, which are basically the sats in your wallet. The secret you know allows you to craft a magic spell—a transaction—that will transfer your sats to someone else (or yourself).

It is this interplay of public and private information that defines ownership and property rights in Bitcoin, and it is the interplay of miners, nodes, and holders that is responsible for the enforcement of said rights. And because you yourself will always be able to hold your own key, run your own node, and calculate your own hashes, you will always be able to be self-sovereign.

You yourself can be judge, jury, and executioner in Bitcoin. Your rules dictate which transactions are valid and which are not. Your private key is all that’s needed to create a valid transaction. Your node is all that’s needed to validate said transactions. Your miner has the power to preserve the past. In Bitcoin, you truly are sovereign.

Cryptosovereignty through Cryptoeconomics #

Because bitcoin is digital money without any central authority, enforcement has to happen via cryptography and the cost of breaking cryptography. We do not have the luxury of making use of various efficiencies that central authorities bring: removing central authority is the whole point.

As mentioned previously, authority is removed via an asymmetry in cost. Cryptography makes it possible to create barriers that can not be violated by force. Such a barrier does not exist in the physical domain; it only exists in the informational domain: in the realm of ideas.

Allow me to repeat an important point: Bitcoin is a crypto_economic_ system, so we have to differentiate between two types of asymmetries: cryptographic ones and economic ones.

Your private information is secured by secrecy and strong cryptography. Your public information is secured by sunk costs and the incentives to be reimbursed for said costs. The first security guarantee is mathematical; the second is economic 15.

Both are rooted in the physical limits of computation. Both massively favor the defender, which is why—if you are absolutely hell-bent on using combat language—bitcoin is a shield, not a sword. It is indestructible bulletproof glass, not a gun.

“With cryptography in the digital domain there is an impenetrable asymmetric defense advantage. It’s like everyone is walking around with a nuke proof personal force field.”

Your private key is secure because no amount of compute will ever be able to guess it. It’s about physics, not technology, as Bruce Schneier pointed out: “These numbers have nothing to do with the technology of the devices; they are the maximums that thermodynamics will allow. And they strongly imply that brute-force attacks against 256-bit keys will be infeasible until computers are built from something other than matter and occupy something other than space.”

Your UTXOs are secure because it takes an economically unfeasible amount of compute to change the past that brings said UTXOs into existence.

All of Bitcoin’s security is rooted in the fact that computation requires energy. The mathematical binding that protects Bitcoin’s private keys is just way stronger than the economic binding that protects Bitcoin’s public ledger, but it is very similar in nature. The main difference is that we can’t rely on the “absolute” security that private keys would bring because we don’t have the luxury of referring to a quorum that would hold this private information. We have to rely on game theory and economics.

The game-theoretical aspects of Bitcoin are probably the hardest to understand because there is no way to have absolute proof of any security guarantee in the future. It is impossible to say how thick the shield has to be, to stick with the previous metaphor. We can not know how much effort a dishonest player is willing to muster. And, as long as the game can be played anonymously, all a dishonest player can do is make moves in the game itself: by speaking words, by providing information to other players.

Non-Violent Play #

Here is the real innovation that Bitcoin brings: Nakamoto Consensus allows us to settle disputes without the threat of violence. Disputes are settled via a probabilistic game, a game of words and math, with multiple parties competing in their own self-interest. Once the dispute is settled — buried under a few blocks of provably rare information—it is settled for good.

We can rely on the eventual settlement of disputes because of probabilities and determinism: random selection and deterministic computation.

Computation, like thinking, requires energy. While the game might be abstract, the electrons are not. To play the Bitcoin game at any meaningful speed and scale, electricity and specialized equipment have to be used. This is no different than TCP/IP, one of the base protocols of the internet. We could run TCP/IP on carrier pigeons — there is even an official specification for that — but for the sake of efficiency, we use computers and high-speed communication networks. The same is true for LNP/BP—the Lightning Network Protocol, and the Bitcoin Protocol. We could use pen and paper to play the game, but it wouldn’t be very efficient or very useful.

While the physical infrastructure that is used to play Bitcoin more efficiently is prone to violent attacks, the essence of Bitcoin and the data it produces are not. Bitcoin is code. Bitcoin is speech. Bitcoin is text. As are all private keys and the public ledger that defines the UTXO set.

Once the players have hashed it out — pun intended — the potential for violence quickly moves to the background. The one-way street of Bitcoin’s difficulty-adjusted proof-of-work transmutes kinetic energy into intersubjective assurances that are valued by individuals, assurances that exclusively reside in the domain of information.

Bitcoin’s proof-of-work serves as a bridge between the world of atoms and the realm of information. This bridge can be built in one way and one way only: by coming up with information that is so unique, so preposterously unlikely, that certain things had to happen in the real world for this information to appear. The rules of the game and the nature of physical law allow for no other possibility.

Because the information speaks for itself, once a valid block is found, we move from the domain of violence to the domain of ideas. The work is done, the word has been spoken, and as soon as this information propagates to other players, the cat is out of the bag. Flesh became Word, and words — like ideas — are bulletproof.

It is this transformation, the “reification of information,” as waxwing calls it, that makes bitcoin an inalienable right. You can hold sats in your head if you manage to memorize 12 words. You can play bitcoin with pen and paper if you are so inclined. Every aspect of Bitcoin can be transformed into speech.

Because Bitcoin is speech, participating in and holding Bitcoin is exercising your God-given right to speak and think. The fact that you are using a Turing machine connected to a digital communications network to speak and think more efficiently doesn’t matter. It is all text, all the time—communication, not violence.

Others have written about the nuances and implications of the above at length, most notably Erik Cason and Eric Voskuil. I recommend reading their respective works—Cryptosovereignty & Cryptoeconomics —in full if you want to understand said nuances and implications deeply.

“The code alone is sovereign. There is no exception.”

— Erik Cason

Bitcoin provides an automated framework for trust-minimized, digital money. It defines the rules of the game and makes changing these rules incredibly hard because new rules have to be backward-compatible and adopted voluntarily by its users.

No central authority dictates the rules. You learn the rules, and you either agree to play the game or you don’t. Wherever two people meet that play according to the same rules, the game can be played. What differentiates play from other things—war, for example—is that play is voluntary. You have to agree to it. Nobody can force you to play a game that you don’t want to play.

The fact that Bitcoin is a game of language is equally important. Speaking does not infringe on anyone else’s rights. In a free society, you should be able to speak freely. In a free society, nobody should be able to force you to speak or dictate what you say. Even when living under tyranny, nobody can force you to think certain thoughts or take them away from you. “Thoughts are free,” as the German folk song goes. “No person can know them, no hunter can shoot them.”

Consequently, the rights and freedoms granted to you by Bitcoin are independent of the rights and freedoms granted by the state. Bitcoin embodies your natural rights; it does not grant you legal rights. The part that is hard to grasp is the Gordian knot of interlocking incentives and cryptography that makes up the judge, jury, and executioner of the Bitcoin network. When push comes to shove, there is no authority: it’s all you. You can be your own judge, jury, and executioner if you are so inclined.

That’s why “21 million” is sacrosanct. It is sacrosanct to me, and I will continue to play this game according to the rules that bring 21 million into existence. I will refuse to play by any rules that would lead to a change of this limit, just like I will refuse to play chess on any board that is larger or smaller than 8x8 squares. When someone knocks at my door and forces me to change the consensus parameters of my Bitcoin node, I will refuse. And if someone else is as stubborn as I am—given that we have a way to communicate—the Bitcoin network will exist.

This, finally, brings me to the last bend of the Gordian knot that speaks Bitcoin’s freedoms into existence: responsibility.

Responsibility #

“Freedom makes a huge requirement of every human being. With freedom comes responsibility.”

— Eleanor Roosevelt

I see it as my responsibility to exercise these inalienable rights and stand for the values that Bitcoin embodies. “Running the numbers is not a crime,” as a good friend of mine once remarked. It is my responsibility to hold my own keys and run my own node. It is my responsibility to know the rules. It is my responsibility to accept or refuse changes. It is my responsibility to exercise my right to free speech and free thought. It is my responsibility to buy and hold bitcoin, to use it, to imbue it with value.

The freedoms that Bitcoin grants me—the freedom to transact, the freedom to save, the freedom to remain private—are a consequence of sovereign individuals all over the world likewise shouldering these responsibilities, voluntarily. They might do it out of necessity, or out of economic self-interest, or because they simply believe that it is the right thing to do; but they all do it because they accept the rules and believe that the Bitcoin game is a worthwhile game to be played. They all agree that Bitcoin is valuable.

I want to emphasize again that Bitcoin is all text, all the time. Consequently, it is a game of thought and speech, and thus you don’t need anyone’s permission to play it. By holding your own keys and running your own node, you exercise your natural right to think (do math) and speak (broadcast information). It is a game that is most beneficial when played with others, but other players are not strictly necessary. I can play it alone, just like Satoshi did when he ran the first Bitcoin node. Playing alone is neither fun nor very useful, but it is and always will be possible. And as soon as a communication channel exists, a second player can join.

In Bitcoin, the individual is sovereign. By shouldering these responsibilities, you, the sovereign individual, are saying: “My thoughts are mine and mine alone. I will speak freely, about whatever I want and with whom I please. It is my God-given right to protect myself; I will not be stolen from.”

Consequently, the enemies of Bitcoin are enemies of freedom and sovereignty. They are saying: “I don’t want you to have these rights. I don’t want you to speak freely. I don’t want you to use your capacity to think about whatever you want. I don’t want you to have the freedoms that this language game bestows upon you. I don’t want you to transact freely. I don’t want you to protect your savings.”

Yes, governments can pass laws that outlaw the use of Bitcoin. However, Bitcoin works the way it works precisely because such a ban is anticipated, not feared. Bitcoin nodes send and receive messages, as do miners. The fact that some of these messages are hard to craft is a feature, not a bug. It is individuals that give these messages value; individuals that have 12 words stored somewhere; individuals that believe in the core value of Bitcoin in the first place: financial freedom and the separation of money and state.

Conclusion #

Law, Language, and Money. Out of these three, only law and language were allowed to evolve, as Hayek pointed out. The money was captured, by banks and the state alike. It is this capture that is at the root of all monetary evil. A capture too profitable to ever give up.

Because of this capture, Satoshi knew that he could not ask for permission to evolve the money. He had to find a roundabout way that uses language to speak the Hayekian dream of a stateless money into existence. A money that creates and enforces its own set of laws:

- You shall not confiscate.

- You shall not censor.

- You shall not inflate.

- You shall not counterfeit.

This is the essence of the laws of Bitcoin, a global and neutral money accessible to all. Anyone can enforce these laws through speaking and listening with their nodes: accepting valid messages and rejecting those that break the rules. Anyone can contribute to the cumulative shield that protects Bitcoin’s past. Anyone can craft transactions and run the numbers that define the future. All that’s needed is a way to do the math and a way to communicate with others.

Anyone can play according to their own set of rules. It is overlap and agreement that makes Bitcoin’s rules, not authority.

Thanks to Bitcoin, anyone can use the asymmetric defenses of cryptography to their economic advantage. Asymmetry is at the heart of Bitcoin’s security: hard to guess, easy to verify. Cooperation is rewarded; conflict is not. Your keys are private; the ledger is public. Defense is cheap; disruption is incredibly costly.

It is the asymmetry in cost that gives rise to the cryptoeconomical game theory of Bitcoin. Peaceful and voluntary cooperation; mutually assured preservation. Sovereignty through cryptography.

Law, Language, and Money. A healthy trifecta of these three is absolutely essential for a free society to flourish. If freedom is a value you hold in high regard, this translates to (1) free speech, (2) sound money, and (3) individual property rights. Bitcoin uses (1) to create (2) and enforce (3)—without the necessity of violence. After all, no amount of violence will ever solve a math problem, as Jacob Appelbaum said so beautifully.

We, as a society, are responsible for upholding the sacredness of free speech. You, as an individual, are responsible for exercising this freedom and taking it seriously. In the realm of Bitcoin, this translates to holding your own keys, running your own node, and doing your own proof-of-work.

We don’t need a separate “right to send a transaction.” It is an inalienable right in a free society, a society that takes free speech seriously. We don’t need a law that will allow us to use electricity to do math more efficiently. After all, mining is nothing but an automated way of trying to find a matching random number efficiently. We don’t need a separate “right to have a wallet.” A wallet is nothing but a comfortable way to sign a message—a calculator if you will. We don’t need a separate law that allows you to hold bitcoin. You are a free individual. You have the inalienable right to memorize 12 words in your head.

Nothing of the above should ever be illegal. In a free society, a society that holds certain truths to be self-evident, none of the above should ever be outlawed. If the course of human history has yielded any fundamental insights for the optimization of human flourishing, it is that speech, and the free exercise thereof, is sacred. The Logos is sacred because the ability to speak freely is the fundamental prerequisite for the discovery and communication of Truth itself, the place from which all goodness emanates.

If speech and the free exercise thereof is sacred, then Bitcoin is sacred, because all that Bitcoin requires of you is to think and to speak. Anyone is free to participate in this game of words and numbers; a game that embodies answers to various questions of ethics and morality; a game that is played without an ultimate end, but with absolute limitation: 21 million, never more. It is you that brings this limitation into existence: by shouldering the responsibility of running the numbers, by exercising your inalienable right to think and to speak. And through that, absolute Truth emerges—without the need to spill a single drop of blood.

Acknowledgments #

- Thanks to John, Max, Erik, Mr. Hodl, and my patrons for their valuable feedback on earlier drafts of this essay.

Hayek, F. A. (2009). Denationalisation of money: the argument refined. Ludwig von Mises Institute. ↩︎

This injustice is called the ‘Cantillion Effect’ and is especially pronounced in fiat money because fiat money can be printed out of thin air. For monies like gold or bitcoin, there is no free lunch since the money is not made up. One has to dig it out of the ground. The fact that this ground is mathematical, as is the case with Bitcoin, doesn’t matter much. If you have to perform work to find new units, the money is not fiat money. ↩︎

Jörg Guido Hülsmann, The Ethics of Money Production ↩︎

Nick Szabo, Money, Blockchains, and Social Scalability ↩︎

This includes gifts since you are trading your gift for reciprocity, karma, a friendly society, or similar ideas. See Hülsmann, Graeber. ↩︎

Warmke, C. (2021). What is bitcoin?. Inquiry, 1-43. ↩︎

Beautyon (2018). Why America Can’t Regulate Bitcoin ↩︎

Funnily enough, the encoding problem—the disconnect between the real world and the world of information—is at the root of the problem of digital money. Bitcoin solves this problem via its difficulty-adjusted proof-of-work algorithm, which, I believe, is the only way this problem can be solved. In Bitcoin, the map is the territory. ↩︎

Wikipedia contributors. (2022, March 23). Gödel numbering. In Wikipedia, The Free Encyclopedia. Retrieved at 730,136 ↩︎

Jonathan Bier (2021), The Blocksize War ↩︎

James P. Carse (1987), Finite and Infinite Games ↩︎

Shout-out to bitstein for sharing his view on Bitcoin governance. ↩︎

“It would have been nice to get this attention in any other context. WikiLeaks has kicked the hornet’s nest, and the swarm is headed towards us.” — Satoshi Nakamoto ↩︎

Of course, even though the relationship between a private key and a public key is mathematical, trying to crack this relationship is again a problem of cost. But it is so outrageously difficult to get a private key from a public key that it is not only uneconomical, it is virtually impossible. ↩︎